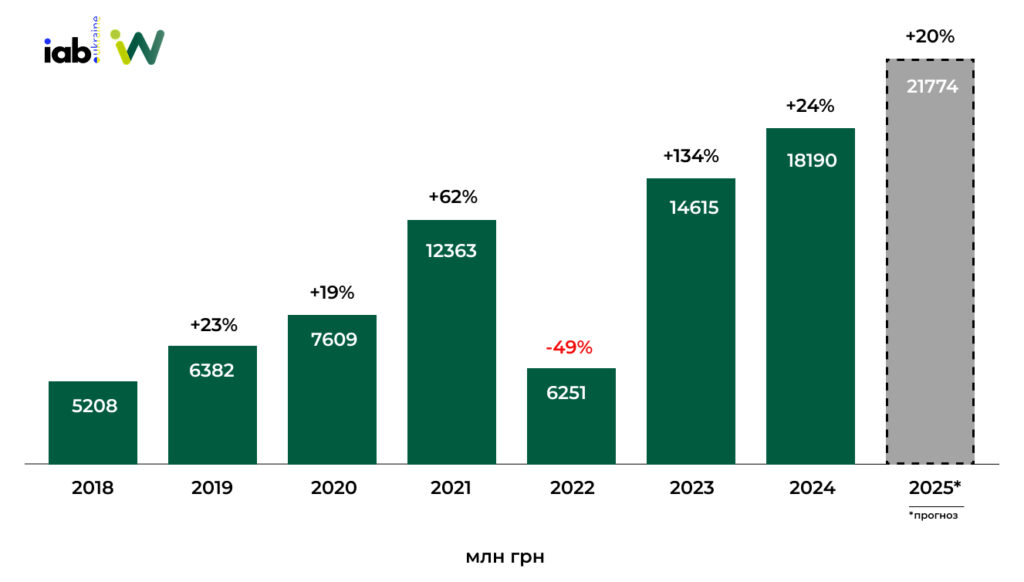

The digital services sector in Ukraine is growing steadily. According to IAB Ukraine, in 2024 the digital advertising market grew by 24% and reached UAH 18 billion. The most dynamic areas include SMM (+66%), influencer marketing (+75%) and SEO (+61%).

Businesses are looking for specialists to manage social media promotion, set up advertising, communicate with the audience, and grow online sales. This means that marketers, targeting specialists, SMM professionals, and other digital experts are in demand.

However, there’s a catch: to work with serious clients or receive payments from abroad – you need to have official status. A sole proprietorship is the most convenient form for those providing marketing or advertising services.

Why is this important?

- Working with legal entities requires official status, invoices, and service agreements

- Platforms and agencies aren’t looking for just specialists, they require registered sole proprietors.

- Receiving foreign payments require a foreign currency account and proof of income

- The tax service and banks are increasingly monitoring “card transfers”

Following our guide for designers, we’ve now prepared a dedicated article for digital specialists, including marketers, targeting experts, SMM professionals, and others involved in online promotion.

Why opening a sole proprietorship (FOP) is the perfect solution for marketers

If you are a marketer, SMM specialist, targeting expert, email marketer, or you work with ad campaigns and promotion – a sole proprietorship on the simplified tax system allows you to work legally, without complications, and with a comfortable tax burden.

Benefits for digital specialists:

- Conduct official transactions with clients by issuing invoices, signing contracts, and receiving payments through a bank account.

- Opportunity to work with legal entities and agencies.

- Group 3 status allows you to accept foreign currency payments from clients in the EU, USA, or Canada.

- Predictable and transparent tax burden: 5% of income, 1% military levy, plus the Unified Social Contribution (USC).

- Simplified reporting. One quarterly report and minimal bureaucracy.

If you work through Upwork, with agencies, manage advertising for a Shopify store, or administer social media for European brands – a sole proprietorship allows you to do this completely legally, without the risk of blocked accounts or audits.

Which tax system should a marketer choose for their FOP?

After registering as a sole proprietor, you need to choose a tax group – this will determine your options when working with clients, as well as your tax burden and reporting requirements. For marketers, SMM specialists, and targeting experts, the most common options are Group 2 or Group 3 of the simplified tax system. However, it is important to consider your client type, area of operation, and cooperation format.

- you work only with individuals or sole proprietors on the simplified tax system

- you provide services within Ukraine

- you do not plan to receive payments in foreign currency

- your annual income does not exceed UAH 6,672,000

This is suitable for a targeting specialist or SMM expert working with local brands or managing pages for Ukrainian clients.

- you work with legal entities (e.g. agencies or companies)

- you receive payments from abroad

- you work through platforms like Upwork, Fiverr, Meta Business Manager, Shopify, etc.

- you want maximum flexibility and scalability

This is the optimal choice for a freelance marketer running ads for European clients or working through agencies.

| Parameter | Group 2 | Group 3 |

| Tax rate | fixed: up to UAH 1,600/month (2025) | 5% (without VAT) or 3% (with VAT) |

| Income limit | UAH 6,672,000 | UAH 9,336,000 |

| Clients | individuals, sole proprietors (STS) | individuals, sole proprietors, legal entities, foreign companies |

| Foreign currency income | no | yes |

| Reporting | annual | quarterly |

| Number of employees | up to 10 | unlimited |

| Military levy | fixed (UAH 800/month) | 1% of income |