Since January 1, 2022, under the Law of Ukraine “On the Use of Registrars of Settlement Operations in Trade, Public Catering, and Services” No. 265/95-VR, the concept of fiscalization has become relevant for most sole proprietors (FOPs).

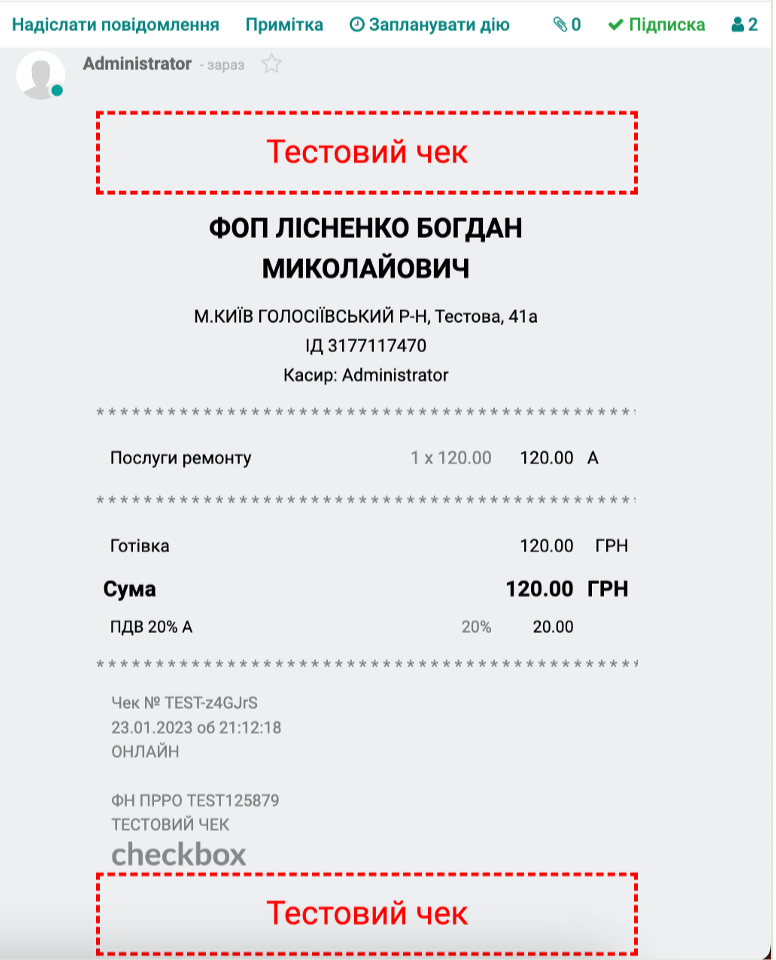

Fiscalization is the process of officially recording cash and non-cash payments through a registrar of settlement operations (RRO or PRRO). In other words, when you receive funds from a client, the payment information is recorded in the tax system as a fiscal receipt. This allows for the monitoring of cash flow and confirms the transparency of business activities.

Unlike traditional RROs, software-based RROs (PRROs) do not require physical equipment and allow for online operation from any device. The Finevolution team assists entrepreneurs in determining whether fiscalization is required and guides them through the proper PRRO integration process—from activity analysis to cash register setup.

Do you need to implement a software-based RRO in 2025?

- Cash

- Bank cards through a POS terminal

- Payment services (e.g., LiqPay, Fondy, WayForPay)

If you were required to use a PRRO but failed to do so, the fine is 100% of the value of the sold goods or services for the first violation and 150% for repeated offenses (Article 17 of Law No. 265/95-VR).

- Payments are received only to an IBAN account (without using POS terminals or payment services)

- Your services are provided exclusively to legal entities via non-cash transactions

- You belong to categories exempt from fiscalization according to Law No. 265/95-VR

PRRO Registration with the tax authorities: Three applications

Before initiating the registration process, ensure you have:

- Access to the taxpayer’s electronic cabinet;

- A Qualified Electronic Signature (QES) or Diia.Signature;

- Up-to-date information about your FOP (NACE codes, address, contact details).

Can You Register PRRO Independently? Technically, yes. However, many sole proprietors encounter errors when submitting applications, resulting in inactive or malfunctioning cash registers. Such mistakes often result in fines due to unintentional violations of the registration procedure.

To correctly register a PRRO for your FOP in 2025, you need to submit the following applications to the tax authorities:

- Application for the Registration of a Business Unit,

- Application for PRRO Registration,

- Application for Cashier Registration.

These applications are submitted through the electronic cabinet. Errors in these forms are a common reason for registration refusals or issues with issuing receipts for each transaction. Even seemingly simple cases can have nuances. To avoid mistakes, it’s advisable to go through this process with a specialist.