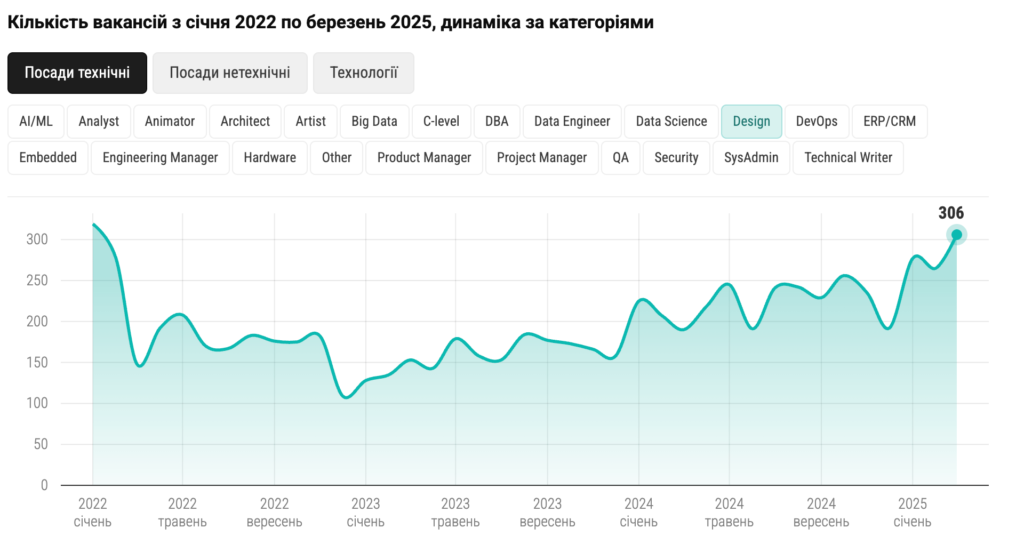

In 2025, the design profession in Ukraine is experiencing a real boom. According to DOU analytics, the number of design job postings has increased by 34% compared to the previous year, indicating high demand for specialists in this field.

However, despite the growing opportunities, many talented designers continue to work without official entrepreneur status. This can lead to several problems:

- Lack of legal protection: Without official status, you cannot sign legal contracts, which increases the risk of non-payment by clients.

- Limitations in financial operations: Banks may block payments or require additional documents to verify the source of funds.

- Inability to participate in official projects: Many companies and platforms require official status for collaboration.

These issues can seriously limit your professional growth and financial stability.

FOP for Designers – The best solution for legal business activity

Registering as a Sole Proprietor (FOP) is the best option for entrepreneurs who want to work legally and expand their client base.

- Legal collaboration with clients: Ability to sign official contracts and issue invoices

- Simplified taxation system: Option to choose the third group of the single tax with a 5% tax rate and 1% military tax on income

- Minimal reporting requirements: Simple bookkeeping with the ability to manage it independently

- Access to banking services: Ability to open a business account and receive client payments

Registering as an FOP for designers opens new opportunities for professional growth and ensures financial stability.

How to choose the right tax group for a designer?

For most designers, the third group of the simplified taxation system is the optimal choice. However, many representatives of the creative industry consider registering as a sole proprietor under the second group of the simplified taxation system due to its fixed tax rate and simpler reporting.

In this case, it is important to consider limitations that may significantly affect your operations, especially if you plan to work with foreign clients or legal entities under the general taxation system.

Comparison of the 2nd and 3rd tax groups for designers

|

Parameter |

2nd Group |

3rd Group |

|

Single tax rate |

Fixed, up to 20% of the minimum wage (e.g., 1,600 UAH/month in 2025) |

5% of income (without VAT) or 3% (with VAT) |

|

Income limit |

Up to 6,672,000 UAH/year |

Up to 9,336,000 UAH/year |

|

Number of employees |

Up to 10 |

Unlimited |

|

Allowed clients |

Individuals and single tax payers |

Any clients, including foreign ones |

|

Possibility to work with foreign clients |

No |

Yes |

|

Reporting |

Annual |

Quarterly |

|

Unified Social Contribution (USC) |

22% of the minimum wage |

22% of the minimum wage |

|

Military tax |

800 UAH/month |

1% of income |

|

Possibility to receive foreign currency payments |

No |

Yes |